Owning a home is a lifelong dream for many, and at Better Engineering Ltd (bel), we make that dream a reality. With our tailored home loan services, navigating the housing market in Bangladesh has become simpler and more accessible. Did you know that Bangladesh’s housing loan sector grew by over 15% in 2022? Whether you’re a first-time buyer or looking to expand your home, a well-chosen home loan can open doors to opportunity. Explore everything about our home loan solutions right here and take one step closer to your dream home.

A home loan is a financial solution designed to help you purchase, build, or renovate your home. This type of loan is repaid in manageable monthly installments over time, making homeownership within reach for many.

At Better Engineering Ltd (bel), we understand the evolving needs of homebuyers and offer expert guidance to help you find the perfect services for Home loan In Bangladesh.

A home loan is more than just a convenience; it is another investment value you are adding to it. Our clients come to us for a home loan in Bangladesh for a lot of reasons, and here we provide some of them:

With our tailor-made loan plans, you can choose repayment timelines based on what you can manage.

Secure a home loan with interest rates that are lower than those of personal loans, saving you money over the long term.

Under Bangladesh law, home loan borrowers can enjoy tax exemptions on both principal and interest payments, significantly reducing your financial burden.

Timely repayment of your home loan strengthens your credit history and score.

Bangladesh has a number of affordable homeownership schemes in place, and the government supports first-time buyers by providing favorable Home loan In Bangladesh. .

In Bangladesh, you can pay off the loan in advance, completely without paying any penalty fees for Home loan In Bangladesh, which helps save interest fees as well.

Some housing loans are offered at affordable rates and under better terms under special schemes by the government to benefit the low and middle-income groups.

Bangladesh real estate market will provide you stability and value appreciation since home is a good long-term financial investment.

better engineering Ltd (bel) offers a range of home loan options tailored to meet your unique needs.

Not sure if you qualify for a Home loan In Bangladesh? The following are the main conditions for getting loan approval in Bangladesh:

In Bangladesh, the minimum and maximum age limit to take a home loan is 21 years and 65 years respectively. But the borrower’s maximum age at the end of the loan tenure cannot be above 65 years. However, wherein there are strong repayment capacity or additional guarantors, banks may extend the flexibility for retirement-age applicants.

Earnings Stability: You have to be salaried or self-employed, and that too, with a stable and verifiable source of income. Most banks in Bangladesh need you to have a minimum monthly income (usually in the BDT 25,000–50,000 range, depending on loan amount) to show repayment ability. Some schools also accept secondary income sources, like rental or spousal income, to qualify.

For salaried persons, a minimum of 1-2 years of continuous service with the same employer is required. For self-employed applicants or owners of businesses, most banks also look for compliance in the form of business performance for a duration of 2-3 years, tax returns, trade licenses, audited financial statements, etc.

Having a good credit history is essential. In Bangladesh, banks verify your credit score from Credit Information Bureau (CIB) of Bangladesh Bank. Any past smallest default or overdue loans in your credit report can considerably decrease your chances of approval. It also advises applicants to have timely repayments of existing loans or credit card dues to build a strong credit profile.

Total monthly debt payments, including new home loan, should not exceed 40-50% of your monthly income depending on the bank’s policy. This enables you to have plenty of disposable income remaining for other living expenses and unexpected events..

The property under financing must have clear, legal ownership documentation. Banks in Bangladesh require the submission of the property deed, mutation records, up-to-date tax clearance, layout plan, and approvals from local authorities, like the Rajuk (for properties in Dhaka) or other city corporations. Any disputes or incomplete documents can delay or cancel the loan approval process.

According to Bangladeshi home loan rules, the borrowers will have to pay a down payment of minimum 20-30% of the total price of the property. Banks usually provide 70-80% of the purchase price, depending on the credit ratings of the applicant and the policies of the bank.

Home loan tenure in Bangladesh varies from 5 years to 25 years, depending on the eligibility and policy of the bank. However, the loan term is influenced by the age of the borrower, as younger applicants are entitled to longer maturities. The tenure is at the bank’s discretion based on the financial health and repayment capacity of the borrower.

Before the loan disbursement, the banks in Bangladesh legally and technically verify the property. This is to ensure the property also complies with the local building and zoning regulations. The applicants might also have to pay legal verification and valuation fees.

In Bangladesh, or in case of the applicant’s salary or credit history does not fully satisfy the criteria with some banks, a guarantor will be needed to provide more security. A guarantor is typically someone who has a good credit score and a good financial situation.

Many banks in Bangladesh offer home loan insurance, which protects the borrower against death, disability or damage to the property. It ensures loan payment continuity in emergencies.

Tax may be deductible up to income tax laws for interest payments if any borrowers home loan in Bangladesh. Borrowers should talk to a tax advisor to be sure they are taking the full deduction they can.

In some Bangladeshi bank the early repayment of the loan is chargeable, whereas some banks give flexibility without deducting a penny. Before signing, be sure to look at the prepayment terms in the loan agreement.

Most of the banks in Bangladesh charge a token, non-refundable processing charge for home loan applications, which is usually between 0.5% to 1% of the loan amount. The time from initiating a loan to its approval varies depending on document verification and compliance checks — from 15 to 45 days.

To streamline the process, gather these documents before starting your application with BEL:

Interest rates are the most clustered option in choosing a home loan, and thus bel promises transparency throughout.

Decide between a fixed rate, which ensures predictable payments throughout the loan term, or a floating rate, which may vary based on market conditions and could decrease over time. In Bangladesh, fixed rates are often preferred for stability, but floating rates can offer savings if market rates decline.

The Bangladesh Bank controls interest rates in Bangladesh and are currently lower for certain loans, including home and SME loans. Nevertheless, rates may vary depending on the lender, loan type, and economic conditions, so staying updated on market trends is essential.

Always shop around and check rates at several banks and financial institutions. Scrutinize the terms, including when you need to pay it back and any hidden fees, so you aren’t surprised later. Under Bangladeshi law, borrowers have a right to clear terms and conditions. Try for flexible repayment option and rate discount if any offer available while negotiating with bel.

With BEL, applying for a home loan is a stress-free process. Here’s how to get started:

Every big financial step comes with its challenges, but BEL is here to help you overcome them.

increasing availability of home loans has changed the landscape of the housing sector in Bangladesh.

Here’s a look at some of the emerging trends in Bangladesh’s home loan landscape:

At better engineering Ltd (bel), we are committed to offering you personalized home loan solutions that are reliable, transparent, and customer-centric. Today you can: apply for a loan, check your loan eligibility, compare loan rates, view loan status, track Equated Monthly Installment (EMI) and much more. We walk you through every step, from application to approval. With Bel, your ideal home is just a call away. And now, with our help, you can make this happen today!

Bangladesh, home loans are a friendly weapon against housing goals. If you understand the process, benefits and challenges with bel, you are ready to make a smart financial decision. Compare loans now and get one step closer to making your dream come true. Buy, build, or renovate — bel is your partner to help you make it happen. Learn more on google.

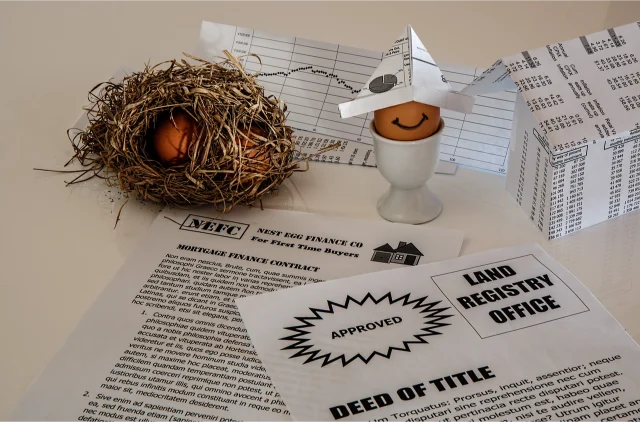

This workflow outlines the step-by-step process for securing a home loan. It includes initial consultation, loan application, document collection, application processing, and final approval. Each stage is designed to streamline the mortgage journey, ensuring clear communication and efficient handling of your loan from start to finish.

Meet with clients to discuss their home loan needs, financial situation, and goals. Provide an overview of loan options and the application process

Assist clients in gathering necessary documentation (income, credit history, assets) and submit it for pre-approval. Evaluate their financial standing to determine the loan amount they qualify for

Complete and submit the formal loan application on behalf of the client. Coordinate with lenders to process the application, including credit checks, property appraisals, and verification of financial details

Review the loan application and all supporting documents. Work with the lender to address any issues or additional requirements. Obtain final approval and prepare for loan closing

Coordinate the closing process, including signing of final documents, transferring funds, and completing any remaining paperwork. Ensure all conditions of the loan are met and finalize the loan agreement

Provide ongoing support to clients after the loan is finalized, including answering questions, addressing concerns, and providing information on loan management and payments

Check Out Our Other Services

WhatsApp us